As a business owner imagine how it would feel at the end of the year to look back and realize you have reached one or more important accomplishments. You used your values to create a strategy. You set a goal at the beginning of the year. You created a plan to act to accomplish the goal. You executed the plan by acting to reach the goal. The feeling would be one of satisfaction and a sense of accomplishment.

For most owners this feeling of satisfaction will not be possible. Most will not have articulated their values and created the strategy to set the goal. Some will not have published the plan so that actions were taken to reach the goal. A few will have set the goal and created a plan but not attained the goal. Those few will be able to ask the question: why did it not work out as planned? Then they will be able to revise the planning to accomplish the goal.

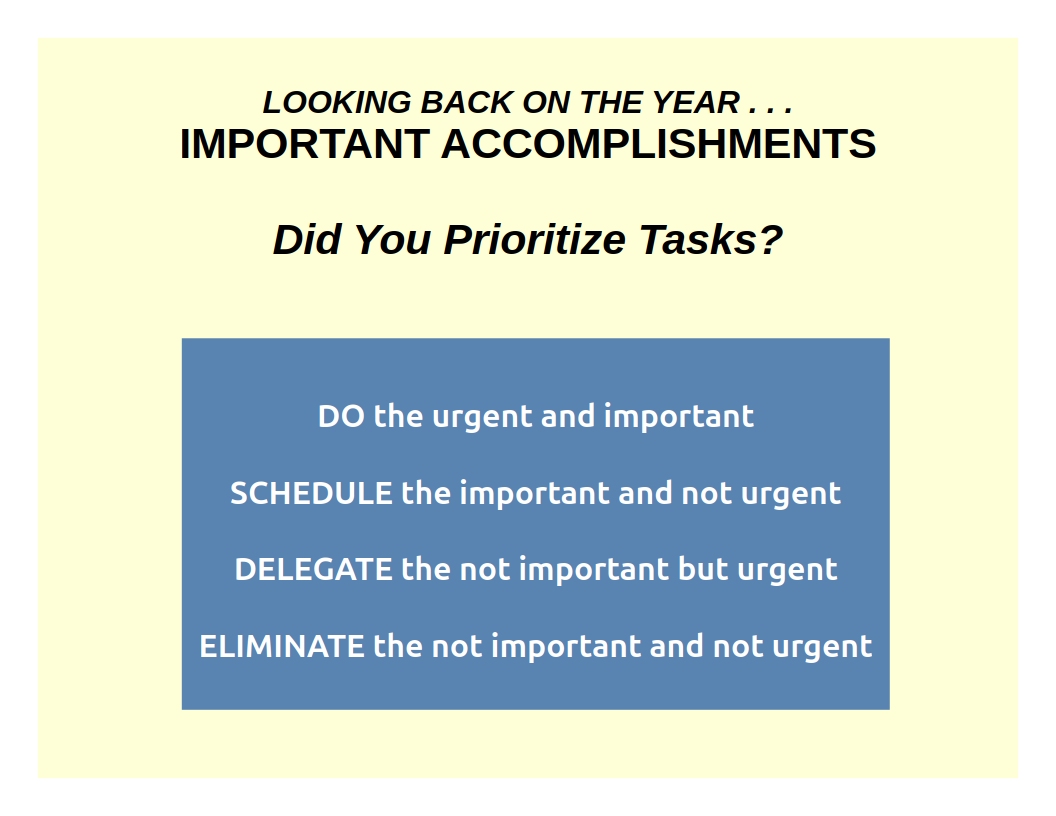

But for those without a plan, and especially for those without a strategy, what happens is that urgent but not important tasks have taken time and effort away from important tasks that lead to significant accomplishments. The failure to articulate values and create a strategy causes a lack of focus on what is important. The function of a strategy narrative is to define what is important. Without a plan based on that strategy to accomplish important goals, the urgent will overtake the important.

Do not let time continue to pass without defining what is important. Do not let another year go by without important accomplishments. Here is what you can do immediately to prevent that.

1. Define what is important in twenty minutes. Take no more than five minutes and a blank sheet of paper and list what is important to you. After five minutes, categorize what you have written. For example, you may have written the following list of what is important: “supporting my family, maintaining my health, contributing to the community, and leaving something behind for those who follow me.” These can be categorized into: “family, health, community, and legacy.” Now take five minutes, look at your calendar, and review the last four weeks. On a separate sheet of paper, categorize the activities and list the average hours per week you engage in the activities. For example, in an average week of 168 hours, you might spend 49 hours sleeping. You might spend 21 hours eating. You might spend 14 hours on personal hygiene and care. You might spend 40 hours working. You might spend 4 hours exercising. You might spend 4 hours running errands. This leaves 36 hours. For most of us what we do with those 36 hours is based on a sense of urgency rather than a decision about what was important. Nonetheless, categorize the activities you did for that time. Notice if any of these categories match the important categories you listed before. Start with a clean sheet and in five minutes answer the question: “What do I desire?” You should be selfish – list what you want most out of life in terms of what makes you happy or satisfied. You now have three sheets of paper and we are fifteen minutes in. One sheet lists the first important items that came to mind, one lists what you have chosen to do with your time, and one lists your desires. Is there a coherence? Do the personal values you have as to what is important match how you spend your time? Is that really what you want? A strategy helps us put these things together by documenting your careful consideration of what is important and desired to enable better day-to-day decisions about how to spend your time. In the next five minutes again write down what you think is important but also list the tasks that are required to accomplish what is important. This is a way of articulating your personal values and is a written personal strategy.

2. Relate your values and personal strategy to your business using the Prior Diligence strategy as a template. Draft a strategy for your business. Use group decision-making procedures to review the strategy with your co-owners. Agree on a business strategy with your co-owners.

3. Compute the time you have available in the average week and schedule the times you will devote to important business strategy tasks. The tasks include creating a business plan with reasonable milestones and timelines from the strategy with your co-owners.

4. Use Dynamic Planning to execute and revise the plan.

My Substack site, Owning a Business (https://rickriebesell.substack.com/) is devoted to a discussion of Prior Diligence, a strategy that is the basis for planning to accomplish the result of realizing the highest possible value from ownership of a business interest.

The components of Prior Diligence are: separation of the owner from management, the presence of co-owners, the implementation of a buy-sell agreement among the owners, a sale to an unrelated outside buyer, and management of the business with Dynamic Planning. All of these components are described with more detail in the archives of the Substack site, Owning a Business. The chat feature of the site, which I moderate, is a place of community for business owners to learn and help others solve entrepreneurial ownership problems.

Next year be the business owner who looks back and realizes that one or more important accomplishments have been reached. You used your values to create a strategy. You set a goal at the beginning of the year. You created a plan to act to accomplish the goal. You executed the plan by acting to reach the goal. The feeling will be one of satisfaction and a sense of accomplishment.