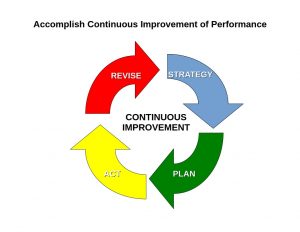

- Accomplish Continuous Improvement of Performance

To ask that every performance be better than the last is to place tremendous pressure on the performer. The aspect of performance is at the heart of most endeavors. Intuitively, we know that performance is not a constant, but in a competitive situation, the goal is for it to improve over a set period of… Read more: Accomplish Continuous Improvement of Performance

To ask that every performance be better than the last is to place tremendous pressure on the performer. The aspect of performance is at the heart of most endeavors. Intuitively, we know that performance is not a constant, but in a competitive situation, the goal is for it to improve over a set period of… Read more: Accomplish Continuous Improvement of Performance